Hi there

Since I recently started using the app I came across a similar problem, and I totally can understand the goal to keep everything as simple as possible.

I don’t have a problem with exchange rates, when paying by credit card, I would simply add or include them in the original expense .

Same goes for additional fees.

What actually would be interesting are ATM cash withdrawals as kind of transfer from one payment type to another.

a) to track them in general:

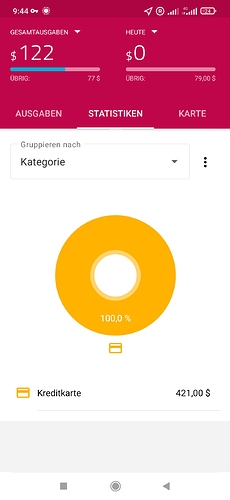

All individual expenses done in cash or by credit cards are registered as those in travelspend.

To make an inventory

- for credit cards I can check my online banking data and see what got in, out and current balance.

- for my cash I can only see current balance (what’s in my physical wallet) and what went out (things I documented on travelspend), but I don’t see what came in…, which would be the ATM withdrawal

This would be the connection between cash and credit card.

B) it would allow to consider the actual exchange rate that has been used to get the physical local currency.

While writing this post I also was testing some things in the app and came across the following workaround:( maybe worth to document somewhere as a tip as long as transfer transactions or similar are not available, yet. )

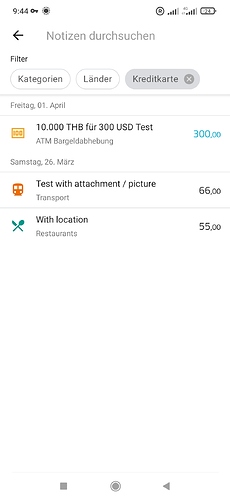

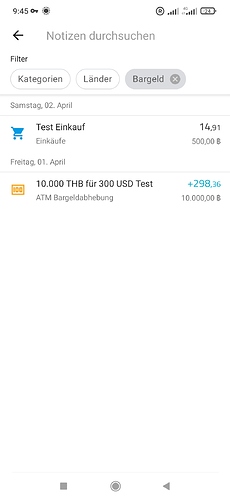

I added category ATM withdrawal.

For each withdrawal I created two payments.

One payment with home currency and estimated amount that will be charged to my credit card. (Payment type = credit card)

Another payment with foreign/local currency with the amount of money I received from the ATM. (Payment type = cash)

For both payments I enabled the option to exclude them from daily budget calculation.

For local currency payment I set the checkbox to define it as a refund of a deposit.